Appliance Repair Business Insurance: Protect Your Technicians

Get tailored and hassle-free insurance

Home » Appliance Repair Insurance

Written by Curran Clark

Co-Founder & Licensed Insurance Producer

Written by Charlie Hughes

Co-Founder & Licensed Insurance Producer

- Appliance Repair Business Insurance Considerations by Business Stage

- General Liability Insurance for Appliance Repair Businesses

- Workers' Compensation Insurance for Appliance Repair Businesses

- Additional Insurance Coverage for Appliance Repair Businesses

- Get Your Appliance Repair Business Insurance Quotes Today

- Appliance Repair Business Insurance FAQs

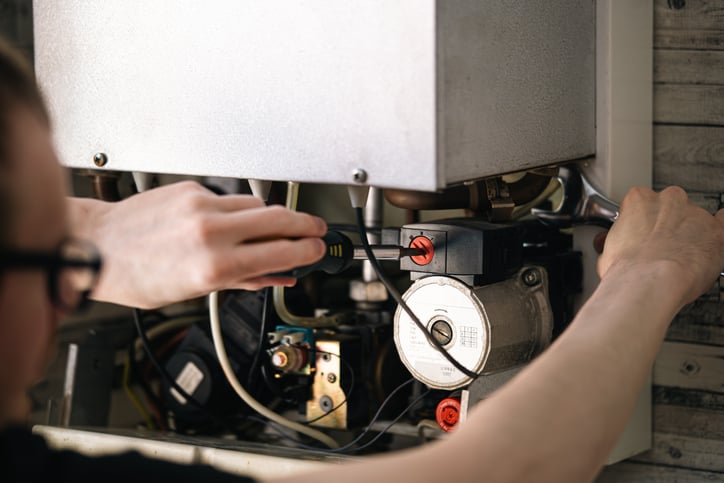

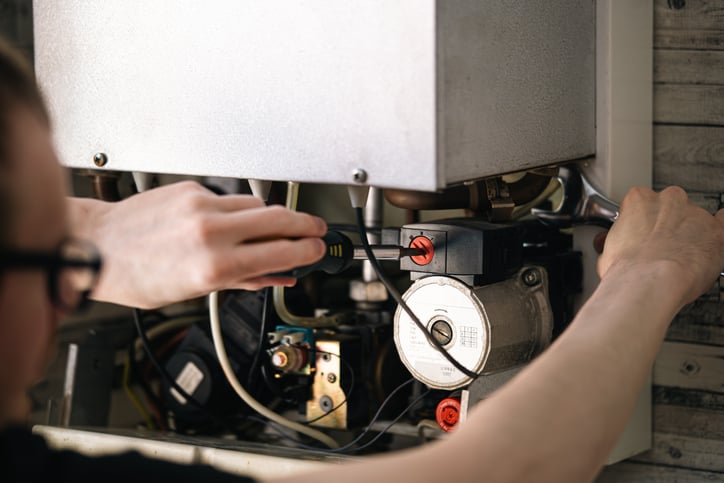

Appliance repair business insurance requires comprehensive coverage to protect against the unique risks of installing and servicing complex household and commercial equipment. The specialized nature of appliance work, from handling expensive smart home appliances to installing commercial-grade kitchen equipment presents distinct challenges and potential liabilities. Installation errors can lead to water damage, electrical issues, or gas leaks that may create immediate hazards or develop into costly problems months after installation.

At ContractorNerd, our proprietary quote platform connects you with contractor-friendly insurers who understand your specialized risks. Our team of tech-enabled and specialized agents streamlines the insurance process, helping you compare quotes from multiple carriers designed specifically for appliance repair professionals. Get your personalized insurance quotes today to ensure comprehensive protection for your business.

What This Guide Covers

This comprehensive guide provides essential insurance information for appliance repair businesses, including:

- Coverage requirements by business stage – from sole proprietor to established company

- General Liability insurance with national quote benchmarks and classification codes

- Workers’ Compensation requirements including NCCI Class Code 9519 details

- Commercial Auto insurance for transporting appliances and equipment

- Tools & Equipment and Installation Floater insurance for specialized protection

- State-specific considerations that influence insurance quotes

Lastly, we invite you to check out related guides for Plumbing Business Insurance, HVAC Contractor Insurance, and Electrician Insurance.

Appliance Repair Business Insurance Considerations by Business Stage

Starting Out Sole Proprietor

Essential Coverage:

- General Liability – Property damage and injury protection

- Tools & Equipment (Inland Marine) – Specialized tools and diagnostic equipment

- Commercial Auto – Business vehicle coverage

- Installation Floater – High-value appliance protection during installation

Growing Small Business (First Employee)

Add to Essential Coverage:

- Workers’ Compensation – Mandatory employee injury coverage

- Umbrella Insurance – Additional liability protection for high-end jobs

- Bond Coverage – Required for commercial projects

- Commercial Property – Warehouse/storage facility protection

Established Business (Multiple Employees & Projects)

Comprehensive Coverage Package:

- Enhanced Commercial Property – Warehouses, showrooms, larger inventories

- Employment Practices Liability – Employee lawsuit protection

- Cyber Liability – Digital payments and smart appliance data protection

- Professional Liability – Consultation and technical advice coverage

Note: Requirements vary by state. Consult commercial insurance agent for specific business needs.

General Liability Insurance for Appliance Repair Businesses

General Liability insurance is essential protection for appliance repair businesses, covering third-party claims for bodily injury and property damage that occur during your operations. For appliance repair professionals, this typically includes:

- Property damage to customers’ homes, appliances, or belongings during installation or repair work

- Bodily injury to customers or bystanders caused by your work or presence on-site

- Product liability claims if a repaired appliance causes damage or injury

- Completed operations coverage for issues arising after you’ve finished a job

- Personal and advertising injury protection against claims of libel, slander, or copyright infringement

Standard coverage limits are typically $1 million per occurrence and $2 million aggregate annually, though higher limits may be required for commercial projects or specific client contracts.

Coverage Classifications

Appliance repair businesses fall under two primary classifications:

Residential Appliance Repair (Class Code 91155) – Covers installation, servicing, and repair of household appliances in residential buildings, including limited LPG work. Excludes commercial work, sales/delivery without installation, and major heating equipment.

Commercial Appliance Repair (Class Code 91150) – Covers installation, servicing, and repair of commercial appliances in commercial buildings and apartments. Excludes residential work, specialized systems like fire suppression, and equipment rental operations.

National Quote Benchmarks

General Liability quotes for appliance repair businesses vary significantly based on revenue and risk factors:

| Revenue Level | National Average Quote | Favorable Rate Quote | Potential Savings |

| $50,000 | $3,750 | $1,600 | 57% |

| $150,000 | $8,740 | $5,170 | 41% |

| $500,000 | $25,900 | $16,150 | 38% |

Quotes typically range from 1.8% to 23.1% of annual revenue, with most established businesses seeing rates in the lower end of this range. Factors affecting your quote include your claims history, coverage limits, deductible amounts, and specific operations mix.

State-Specific Considerations

Insurance quotes vary significantly by state due to different regulatory environments, claim frequencies, and market competition. Our analysis of appliance repair business insurance cost factors demonstrates that businesses maintaining strong safety protocols and proper classification under codes 91155 or 91150 can achieve premium reductions ranging from 19% to 95% depending on their state and operational profile.

Key factors that influence state-specific quotes include:

- State insurance regulations and minimum coverage requirements

- Regional claim frequencies and settlement amounts

- Local competition among insurance carriers

- Weather patterns and natural disaster risks

- State-specific licensing and bonding requirements

Workers’ Compensation Insurance for Appliance Repair Businesses

Workers’ comp is mandatory once you hire employees due to the physical demands and injury risks of appliance repair work.

Your Classification & Rates

You’ll typically use NCCI Class Code 9519 – Appliance Service & Repair, which covers technicians who install, service, and repair both household and commercial appliances. This includes work on refrigerators, washers, dryers, dishwashers, ovens, and other major appliances.

Rates typically range from $3 to $5 per $100 of payroll, making it a relatively moderate-risk classification. Your exact rate depends on your state, claims history, and specific mix of residential versus commercial work.

Common Injuries in Your Industry

- Back injuries from lifting heavy appliances

- Electrical shock during installations

- Cuts from tools and sharp appliance edges

- Crush injuries from equipment

- Slip and falls during transport

Insurance Coordination with Related Trades

Appliance repair businesses regularly interface with other mechanical trades requiring proper insurance verification. Water-connected appliances like dishwashers and washing machines overlap with plumbing liability insurance requirements. Refrigeration equipment shares technology with HVAC contractor coverage needs. All appliance installations require coordination with electrical contractor insurance for proper power connections.

Understanding these coverage boundaries prevents liability gaps when multiple trades work on the same project.

Additional Insurance Coverage for Appliance Repair Businesses

Commercial Auto Insurance

Essential for transporting appliances and equipment to customer locations. Your personal auto policy won’t cover business use, leaving you exposed to significant liability.

Standard coverage limits start at $100,000/$300,000/$100,000, though higher limits are recommended given the value of modern appliances you’re transporting. Coverage includes your vehicle, cargo, and liability for accidents during business use.

Tools & Equipment Insurance (Inland Marine)

Protects your specialized equipment whether it’s in your vehicle, at a job site, or in storage. Essential coverage includes:

- Diagnostic tools and digital meters for troubleshooting appliances

- Specialized installation tools specific to different appliance brands

- Appliance dollies and lifting equipment for safe transport

- Testing equipment for electrical and gas connections

- Digital calibration tools for smart appliances

Coverage typically costs 1-3% of your total equipment value and protects against theft, damage, and loss anywhere you work.

Installation Floater Insurance

Critical protection for high-value appliances during the vulnerable period from delivery to completed installation. You’re responsible for expensive appliances while they’re in your care, and standard policies may not cover damage during installation.

Particularly important for:

- High-end residential appliances ($5,000+ refrigerators, wine coolers, commercial-grade ranges)

- Commercial kitchen equipment where replacement costs can exceed $20,000

- Smart appliances with sensitive electronics that can be damaged during installation

Coverage protects appliances during transit, storage at job sites, and throughout your installation process.

Get Your Appliance Repair Business Insurance Quotes Today

Finding comprehensive appliance repair insurance can be challenging without the right connections. ContractorNerd’s proprietary quote platform specializes in connecting contractors with insurance carriers who understand your specialized risks. Our tech-enabled team of specialized agents streamlines the process, helping you compare quotes from multiple contractor-friendly insurers to find appropriate coverage for your business size and needs.

Ready to protect your appliance repair business? Get your personalized insurance quotes today.

Appliance Repair Business Insurance FAQs

What insurance do appliance repair businesses need?

Start with general liability ($1M/$2M limits minimum), then add commercial auto once you’re hauling appliances. When you hire that first tech, workers comp becomes mandatory. Smart money also gets tools/equipment coverage and installation floater.

How much is insurance for appliance repair business?

You’re looking at $3,750 to $8,740 annually for general liability on $50-150k revenue – basically 2-6% of what you make. Workers comp runs another $3-5 per $100 of payroll. Tools coverage adds 1-3% of equipment value. Most guys pay $5-15k total yearly for decent coverage.

What insurance codes do appliance repair businesses use?

You’ll use Class Code 91155 for residential work or 91150 for commercial jobs – don’t mix them up or you’ll overpay. Workers comp falls under NCCI Code 9519 for appliance service/repair.

Ready to get coverage?

ContractorNerd is here to help get you the right coverage without all the hassle.